Vacation entitlements in Canada are an essential part of employee benefits, but understanding the difference between vacation pay and vacation time can sometimes be confusing. While vacation pay refers to a percentage of an employees vacationable earnings¹, vacation time refers to the actual number of days or hours they are entitled to take off.

It's important for both employers and employees to be aware of their rights and obligations when it comes to vacation entitlements in order to ensure a fair and transparent process. In this blog, we will explore the nuances of vacation pay versus vacation time in Canada, providing clarity on how these entitlements work and what you need to know to stay compliant with employment standards and provincial payroll legislation.

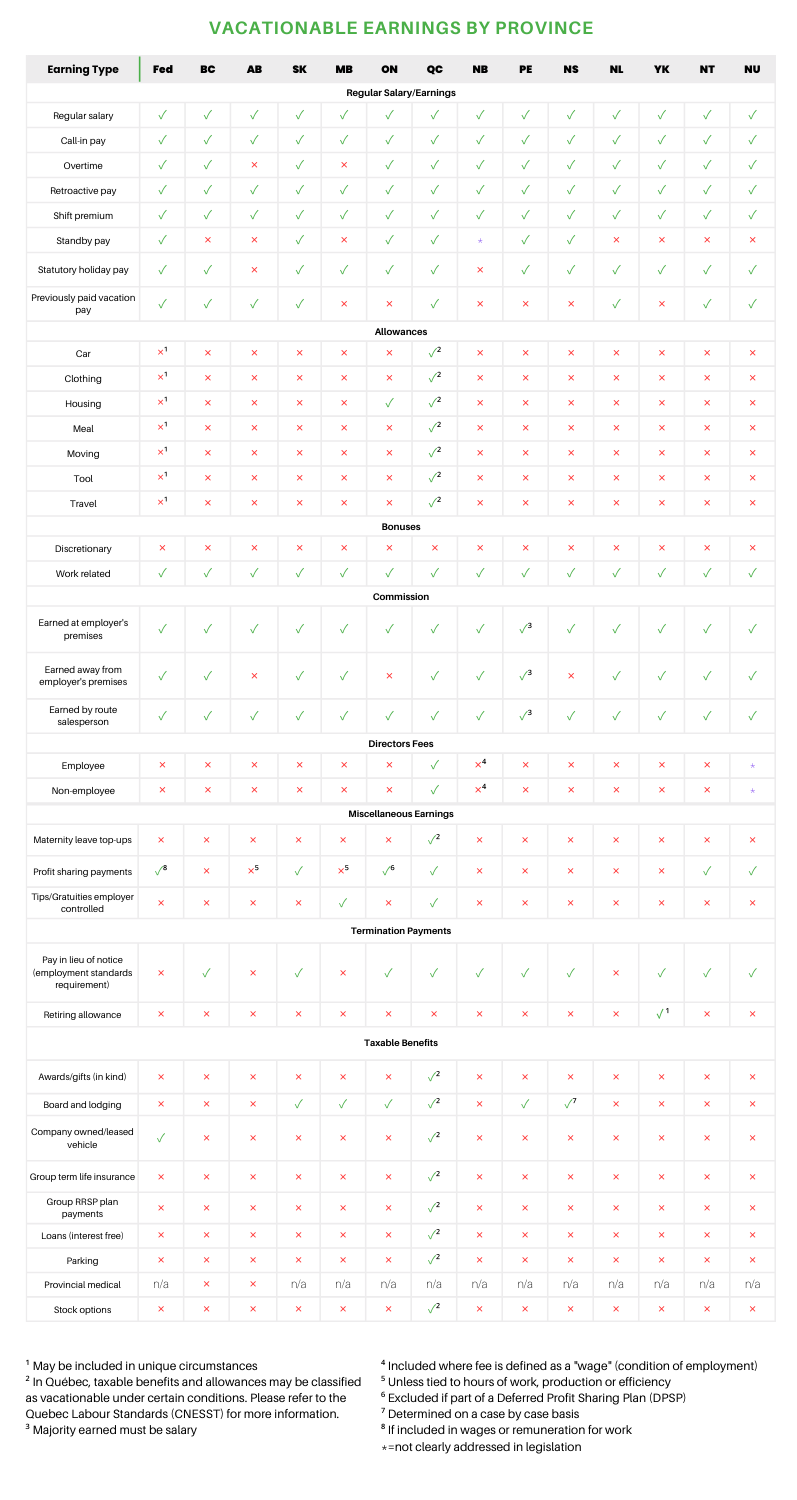

¹Vacationable earnings are the specific earnings used to calculate vacation pay. See below for more details.

- What is vacation pay and how is it determined?

- Vacation pay & payroll

- Vacation entitlements by province

- Tracking vacation pay & time

What is Vacation Pay and How is it Determined?

Vacation pay is a portion of the employee's earnings that is allocated to them during their year of employment when they are eligible for vacation, while vacation time refers to the actual days or hours they are entitled to take off.

Calculating vacation pay involves determining a percentage of the employee's earnings based on their length of service and any specific agreements in place. It is calculated as a percentage of the gross wages earned during the year of employment (continuous employment for the same employer for a period of 12 consecutive months) or another period of 12 consecutive months that your employer determines in accordance with the Canada Labour Standards Regulations.

It is important to note that each province/territory has it's own specific legislation outlining vacation pay requirements. Generally, standard vacation pay calculations are as follows:

- 4% of earnings equal to 2 weeks vacation time

- 6% of earnings equal to 3 weeks of vacation time

- 8% of earnings equal to 4 weeks of vacation time.

Below we've included a chart outlining what qualifies as vacationable earnings. Vacationable earnings are the specific earnings used to calculate an employee's vacation pay, reflecting the compensation they receive for their work.

Vacation Pay & Payroll

As an employer, it is your responsibility to track and pay out vacation pay to your employees. There are several ways you can set this up. You can either pay out the vacation earnings each pay period, or accrue vacation dollars to be paid out later.

It is at the discretion of the employer to decide whether they will accrue or pay out vacation pay each pay period. As an employer, you must ensure you remain compliant with employment standards based on your employees province of residence, and that your calculations are based on qualifying vacationable earnings.

Automating this task is a common feature of payroll services & software, however customizations can be tricky for basic payroll software providers. Make sure your provider can handle any potential support you may need integrating time tracking with pay calculations, or setting up custom vacation pay codes.

You can also check out the CRA's Vacation Pay Calculator here, or download our 2025 Payroll Guide for additional resources.

Vacation Entitlements by Province

Below you will find a breakdown of vacation time & pay entitlements by province or territory. It is important to stay updated on employment standard legislation as the below vacation entitlements may change. You can visit our Resources page or follow us on linked in for updates on legislative changes.

Tracking Vacation Pay & Time

If you are in the process of setting up or running payroll for the first time, it is crucial to establish a system for tracking vacation pay right from the start. Whether you opt to pay out vacation earnings with each pay period or accrue them for later disbursement, maintaining accurate records is essential for compliance and transparency.

By diligently tracking vacation pay, you not only ensure that employees receive their entitled time off benefits but also uphold your legal obligations as an employer.

For businesses that are continuing to grow and maintain tenured employees, you may be looking at more unique vacation agreements with your employees. PayTrak offers custom vacation programming for our clients to easily automate and manage more complex arrangements.

Whether you choose to automate the process through payroll software or handle it manually, prioritizing the accurate tracking of vacation pay is a fundamental aspect of effective workforce management.

When it comes to time tracking, we understand the overwhelming nature of full blown HCM software. While generally offering a wide variety of features and benefits, these types of payroll solutions can leave you confused and overloaded. It's also possible that you use one software for time tracking and another for running payroll. In order to simplify your payroll process, consider what solutions might allow you for the easiest integration or correspondence between your time tracking and payroll tools.

In conclusion, understanding vacation pay and vacation time entitlements in Canada is crucial for both employers and employees to ensure a fair and transparent process. By clarifying the differences between vacation pay and vacation time, calculating vacation pay accurately, and staying compliant with provincial legislation, businesses can effectively manage their workforce while employees can enjoy their entitled time off benefits.

Engage with us for updates on legislative changes and best practices to streamline your payroll process and optimize your workforce management.