When setting up or managing payroll in Canada, one of the most important decisions you’ll make is how often to pay your employees. While many businesses default to weekly, bi-weekly, semi-monthly, or monthly schedules, this choice isn’t just about convenience—it’s also governed by provincial and territorial employment standards legislation.

Each jurisdiction sets its own rules around minimum pay frequency, maximum allowable pay periods, and when wages must be paid. Failing to comply with these standards can result in penalties, CRA issues, or frustrated employees.

Before you choose a payroll frequency (or make changes to your current schedule), here are a few key things to keep in mind:

Key Takeaways

-

Pay frequency is regulated by law in every province and territory—some require payment at least every 16 days, others allow monthly. Non-compliance can lead to fines and other issues.

-

The most common payroll schedules are weekly, bi-weekly, semi-monthly, and monthly—each results in a different number of pay periods annually, which can affect your payroll calculations.

-

Don’t confuse bi-weekly (every 2 weeks = 26 or 27 pay periods) with semi-monthly (twice a month = 24 pay periods). This difference impacts employee budgeting and deductions.

-

Payroll frequency affects deductions for CPP, EI, and income tax—extra pay periods can throw off annual deduction amounts if not properly accounted for.

-

If you’re thinking about switching payroll frequencies, it’s best to do so at the start of a new calendar year to avoid complications with CRA reporting and remittances.

-

Always double-check your province or territory’s employment standards legislation to ensure your payroll schedule remains compliant.

In the sections below, we’ll break down how different payroll frequencies work, the pros and cons of each, and outline the legal requirements across all Canadian jurisdictions to help you make the right choice for your business.

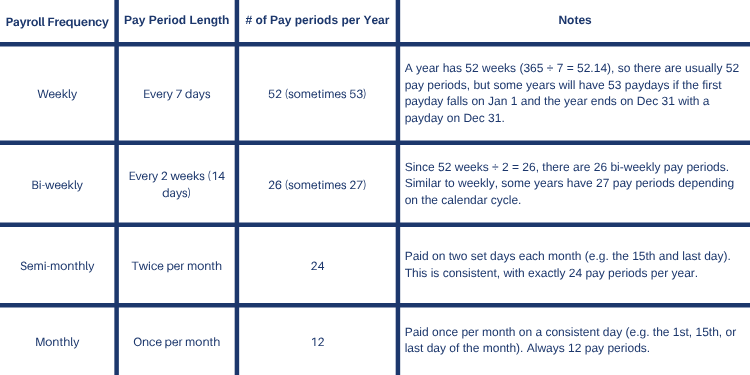

The chart below outlines the number of pay periods associated with each payroll frequency, along with typical patterns and key considerations to help you make an informed decision.

Many employers (and employees) confuse bi-weekly and semi-monthly payroll. The key difference is that bi-weekly pay happens every two weeks (e.g., every second Friday), resulting in 26 or sometimes 27 pay periods per year. Semi-monthly means employees are paid twice a month on fixed dates (like the 15th and 30th), which always equals 24 pay periods per year. This difference can affect budgeting, overtime calculations, and deduction timing.

Provincial & Territorial Pay Frequency Requirements

Mistakes in setting your payroll schedule can result in non-compliance with employment standards, potential penalties, and dissatisfaction among employees—particularly if wages are not paid as required by law.

To assist you in navigating these regulations, the below guide provides an overview of the minimum legal requirements regarding pay frequency and pay period length for each payroll jurisdiction in Canada.

Please note: the information presented here is a general summary intended to serve as a starting point. You should always review the specific employment standards legislation applicable to your province or territory, and consult with qualified professionals or official government resources to ensure your payroll process remains fully compliant.

| Jurisdiction | Minimum pay frequency / pay‑period rule | Source for legislation / official information |

|---|---|---|

| Alberta | At least monthly (pay period must be no more than one “work month”) and wages must be paid within 10 consecutive days after the end of each pay period. | See the Alberta Employment Standards website here |

| British Columbia | At least semi‑monthly: pay periods cannot exceed 16 days, and wages must be paid within 8 days after the end of the pay period. | See the British Columbia Employment Standards Act – Part 3 “Paydays” here |

| Manitoba | At least twice a month: pay period must not exceed 16 days. Wages must be paid within 10 working days of end of pay period. | See Manitoba Labour Standards “Paying Wages and Keeping Records” here |

| New Brunswick | At least every 16 days. | |

| Newfoundland & Labrador | At least semi‑monthly and within 7 days of the end of the pay period. | See Newfoundland and Labrador Labour Standards Act here |

| Nova Scotia | At least twice a month and within 5 working days after the end of the pay period. | See the Nova Scotia Labour Standards here |

| Ontario | No specific minimum frequency: employers must establish a regular pay period and a regular payday. | See the Ontario Employment Standards Act here |

| Prince Edward Island | Pay periods cannot exceed 16 days (i.e., pay at least every 16 days). | See the Prince Edward Island Employment Standards Act here |

| Québec | At least semi‑monthly (a maximum of 16 days between paydays) for most employees. Executives/management may be paid monthly. Also, the first salary of a new hire must be paid within one month of hiring. | See the Labour Standards Act (Quebec) (Loi sur les normes du travail) here |

| Saskatchewan | Hourly‑paid employees must be paid at least every 14 days (or semi‑monthly). Salaried employees may be paid monthly (if salary is expressed as an annual or monthly salary). | See the Employment Standards Government of Saskatchewan here |

| Yukon | At least semi‑monthly: pay no less frequently than every 16 consecutive calendar days. | Download the Yukon Employment Standards Act fact sheet here and navigate to page 6 of the document |

| Northwest Territories | At least monthly, unless a longer pay period is approved by the Employment Standards Officer; wages must be paid within 10 days of the end of the pay period. | See the Northwest Territories Employment Standards Act here and go to page 20 |

| Nunavut | At least monthly: pay periods must be no more than one month unless permission is given; wages must be paid within 10 days after end of pay period. | See the Nunavut Labour Standards Act here |

Changing Payroll Frequency: What to Know Before You Switch

Thinking about switching your payroll schedule from bi-weekly to semi-monthly? It can be done, but timing matters. Changing payroll frequency mid-year can trigger a CRA PIER (Pensionable and Insurable Earnings Review) report if your CPP and EI deductions get thrown off in the process.

That’s because the CRA expects consistent, accurate remittances based on expected pay periods, and a sudden switch can make it look like you’ve under- or over-deducted. To avoid this hassle, the best time to make the change is at the start of a new calendar year, that way, everything resets cleanly and your deduction calculations stay aligned.

If a mid-year change is unavoidable, just make sure you update your payroll software settings correctly and keep clear records to explain the shift. And of course, give employees plenty of notice so they’re not caught off guard by a change in payday timing.

How Payroll Frequency Affects Deductions (Yes, It Matters!)

You might not think payroll frequency has much to do with taxes and deductions—but it absolutely does. The more often you run payroll, the smaller each deduction is per pay cheque, even though the yearly totals for things like CPP, EI, and income tax should add up the same.

That said, weird things can happen when there are extra pay periods—like in a year with 27 bi-weekly paydays instead of 26—which can mess with fixed annual deductions (like benefits or union dues) if you're not careful.

Also, payroll software usually calculates tax deductions based on the assumed number of pay periods in a year, so if you're off by even one, it could lead to under- or over-withholding. Long story short: payroll frequency affects more than just how often employees get paid—it also plays a big role in staying on the CRA’s good side.

Final Thoughts: Pick the Right Pay Frequency and Stay Compliant

Choosing the right payroll frequency isn’t just about preference or convenience—it’s about staying compliant with provincial laws, avoiding CRA issues, and making life easier for your employees. Whether you run payroll weekly or monthly, the key is to stay consistent, follow local employment standards, and ensure your deductions line up with your pay schedule. Before making any changes, take the time to review your province’s rules and double-check your payroll software settings. And when in doubt? A quick call to a payroll expert or employment standards office can save you a major headache down the line.

When working with a payroll provider such as PayTrak, you can expect to receive an annual pay calendar in advance, automatically generated from a reliable, compliant payroll system. Having this schedule allows for effective planning throughout the year. If you intend to adjust your pay frequency, be sure to provide your payroll service partner with ample notice to support a smooth transition. Be sure to check out our Payroll Guide for additional payroll resources.