Get ready to navigate the world of Canadian taxes and ensure you're on top of your year-end tax forms (thrilling, we know). While year-end may not be the most enticing workload to jump into, it doesn't have to be a headache. Whether you're a seasoned pro or doing year-end processing for the first time, we're here to help. With legislative changes affecting payroll and tax filing from 2024 onward, it's important to stay up-to-date and vigilant with your year-end process. In this blog post, we'll provide you with important information, including:

- Understanding the T4 form

- Key deadlines and late filing penalties

- Common mistakes to avoid when reviewing your T4 summary

Understanding the T4 Form

The T4 form is a year-end tax document that employers provide to their employees, outlining their annual income and deductions. It contains important information such as employment income, taxable benefits, deductions, and taxes withheld. This form is essential for individuals to accurately report their income and claim applicable deductions when filing their personal income tax return.

Two new boxes were added to the T4 and T4A forms in 2024.

- Box 45, Employer-offered Dental Benefits, is now mandatory for all T4 slips.

- Box 015, Payer-offered Dental Benefits, will be mandatory for T4A slips if there is an amount reported in Box 016, Pension or Superannuation. However, this box will be optional otherwise.

These updates ensure that dental benefits are accurately reported and accounted for in the year-end tax forms. This is necessary to help determine someone's eligibility for the Canadian Dental Care Plan.

Also in 2024, there was a new C/QPP contribution to consider as part of payroll source deductions. This contribution applies to income above $71,300 and up to $81,200 per year. To accommodate this change, the Canada Revenue Agency has introduced two additional boxes on the current T4 form:

- Box 16A: This box is for reporting employees' second CPP contribution.

- Box 17A: This box is for reporting employees' second QPP contribution.

Key Deadlines and Late Filing Penalties

Understanding the key deadlines and filing requirements can help ensure a smooth and hassle-free process. The deadline for employers to provide employees with their T4 forms is February 28th of the following year. Additionally, employers must submit the T4 Summary, which summarizes the information from all T4 forms issued, along with the related T4 slips, to the Canada Revenue Agency by the last day of February.

Failing to meet these deadlines can result in penalties and interest charges. It's essential to stay organized and submit your tax forms on time to avoid any unnecessary complications.

Late Filing

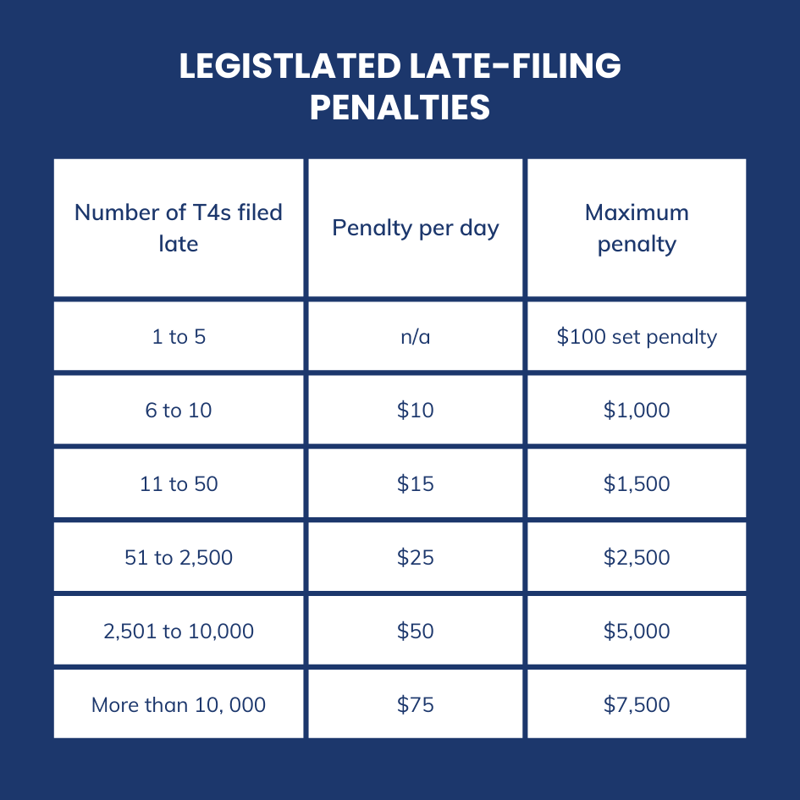

Late filing of your T4 information return can result in penalties from the CRA. The penalty amount is determined by the number of T4 information returns filed late and is calculated according to the chart provided. The minimum penalty is set at $100.

In the event that T4 information returns are added or cancelled, the late filing penalty will be recalculated based on the updated count and the number of days they are overdue. You will receive a new notice of assessment reflecting the revised penalty amount. To ensure fairness and reasonableness for small businesses, the CRA has an administrative policy that reduces the penalty for T4 information returns.

Tips for Efficiently Preparing Year-End Tax Forms

Preparing year-end tax forms can be a daunting task. However, with the right approach, you can make the process efficient and accurate. Here are PayTrak's tips for making year end a bit smoother:

- Organize your financial documents effectively

- Double check and pay attention to the basics

- Consider utilizing professional services & software to assist you

- Do a deep dive into your T4 Summary

Organizing Your Financial Documents

Maintaining organized and up-to-date employee information is crucial for smooth payroll processing and year-end tax filing in Canada. Here are some steps an employer can take to achieve this:

- Start reviewing your year-end payroll reports in November to stay ahead of the game.

-

Use a Centralized Employee Database: Create a centralized database or system to store all employee information securely. This database should include details such as full name, address, Social Insurance Number (SIN), date of birth, contact information, tax withholding details, employment start date, job title, salary, and any other relevant information.

-

Electronic Records: Utilize electronic records instead of paper-based systems to make information management more efficient. Electronic systems can help streamline processes and reduce the risk of errors.

-

Regular Updates: Ensure that employee information is regularly updated. Require employees to notify HR or the payroll department of any changes to their personal information, such as address, marital status, or number of dependents.

-

Payroll Software: Invest in reliable payroll services or software that can automate calculations and generate accurate pay stubs and tax documents.

-

Employee Self-Service Portal: Implement an employee self-service portal where employees can access and update their own information, view pay stubs, and download tax documents. This can reduce the administrative burden on HR and ensure that employee information is always current. PayTrak offers both client and employee self-service portals to make accessing important information even easier.

Double Check and Pay Attention the Basics

When it comes to preparing T4 forms, it's easy to get caught up in the financials and overlook the importance of accurate employee information. However, paying attention to the basics, such as date of birth, mailing address, and Social Insurance Number (S.I.N) is crucial.

Accurate employee information is essential for several reasons. Firstly, it ensures that the T4 forms are correctly filled out, preventing any discrepancies or errors in reporting employee income and deductions. Missing or inaccurate information can result in various challenges and penalties.

For example, if an employee's S.I.N number is incorrect or missing from Box 12, it can delay the processing of their T4 form and potentially lead to a rejection by the CRA. This can cause frustration for both the employee and the employer, as it may require additional time and effort to rectify the situation. You could also be charged a penalty of $100 per missing S.I.N.

Inaccurate date of birth information can also pose challenges, as it is used to determine an individual's eligibility for certain tax credits or benefits.

To avoid these challenges, it is important for employers to prioritize accurate employee information. This can be achieved by regularly updating and reviewing employee records, ensuring that any changes to personal information, such as address or marital status, are promptly communicated to the HR or payroll department.

Utilizing Professional Services

Utilizing professional services during tax season can greatly simplify the process of T4 preparation and maintaining accurate payroll and tax records. Professional services, such as payroll outsourcing or software, can provide expertise and support in navigating the complexities of tax regulations and changing legislation. These services can help you organize financial documents effectively, double-check important details, and ensure timely submission of T4 forms and the T4 Summary to the CRA. They can also provide a platform for distributing employee documentation more easily.

Hint: PayTrak's fully managed payroll services (PayTrak Prestige) come with a zero-defect guarantee, ensuring that any amendments or penalties become the responsibility of PayTrak, since we are the ones handling year-end for you.

Thoroughly Review your T4 Summary

Delving deep into your T4 summary is essential when it comes to accurate tax preparation. This summary plays a vital role in aligning the information reported by employers with what employees actually receive. Through this reconciliation process, any discrepancies or errors can be identified and necessary corrections can be made.

By taking the time to thoroughly review your T4 summary, you can have peace of mind knowing that your tax preparation is accurate and avoid any unnecessary complications or penalties. It is crucial to meticulously review and compare the information and totals in the T4 summary with what has been reported on the employee tax forms before completing the year-end process. It is imperative that these totals align with the remittances submitted to the CRA. This involves verifying the total contributions made for CPP, employment insurance (EI), and income tax.

Common Mistakes to Avoid When Reviewing Your T4 Summary

Preparing a T4 Summary accurately is essential for complying with Canadian tax regulations and ensuring smooth year-end reporting. Here are three tips to help you avoid common mistakes:

-

Thoroughly Review Employee Information: Before completing the T4 Summary, carefully review all employee information to ensure accuracy. Verify that each T4 slip corresponds to the correct employee and that all personal details, such as name, address, and Social Insurance Number (SIN), are correct. Mistakes in employee information can lead to discrepancies in tax reporting and potential penalties.

-

Late Filing: Submit your T4 Summary by the deadline set by the CRA, which is typically the last day of February following the end of the tax year. Failing to file on time can result in penalties and interest charges. Plan ahead and allow ample time for preparation and submission to avoid late filing.

-

Mismatched Totals: Ensure that the totals on your T4 Summary match the corresponding amounts on the individual T4 slips issued to employees. Double-check calculations for total income, deductions, and net income to avoid discrepancies. Mismatched totals can trigger CRA audits or inquiries, leading to additional administrative burdens and potential penalties.

By thoroughly reviewing employee information, double-checking taxable income and deductions, and validating totals and calculations, you can avoid common mistakes when preparing a T4 Summary and ensure accurate year-end tax reporting.

In conclusion, meeting tax deadlines is crucial to avoid penalties and interest charges. To efficiently prepare year-end tax forms, it is important to stay organized, double-check employee information, and utilize professional services if necessary. By maintaining accurate records and thoroughly reviewing the T4 Summary, you can ensure accurate tax reporting and avoid unnecessary complications. If you want to simplify the process and ensure accuracy, consider engaging with PayTrak's fully managed payroll services or check out our Payroll Guide for more helpful information. Remember, taking the time to properly prepare and submit your tax forms can save you time, and money. Don't hesitate to seek professional assistance to make the process smoother.